North Dakota Sales Tax Exemption Verification . Complete this certifi cate and. application for sales tax exemption certificate. sales and use tax requirements. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases.

from www.templateroller.com

a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. sales and use tax requirements. General information and special guidelines for certain types of business. Complete this certifi cate and. application for sales tax exemption certificate. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting.

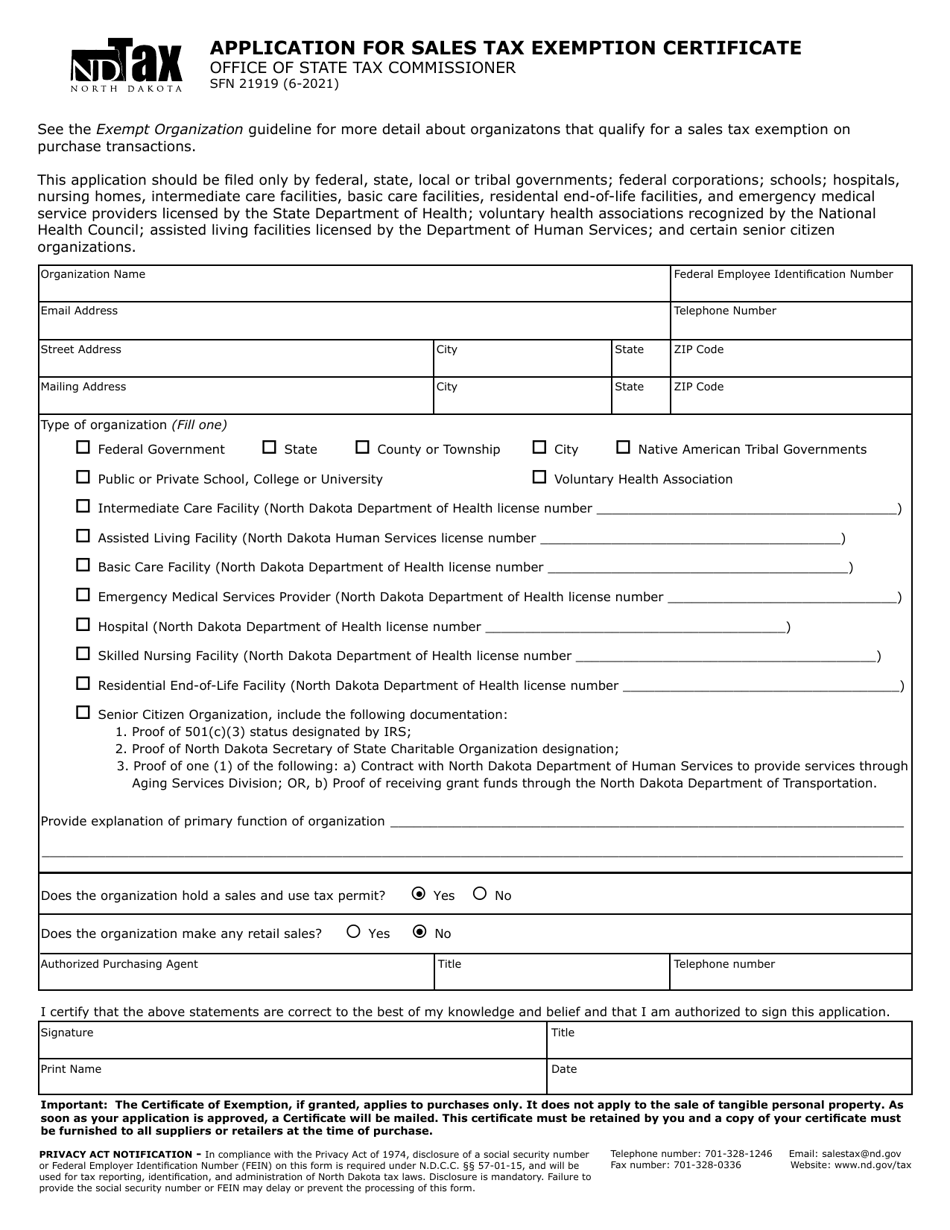

Form SFN21919 Download Fillable PDF or Fill Online Application for

North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. General information and special guidelines for certain types of business. application for sales tax exemption certificate. sales and use tax requirements. Complete this certifi cate and. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting.

From www.vrogue.co

Sales Tax Exemption Certificate Fill Online Printable vrogue.co North Dakota Sales Tax Exemption Verification sales and use tax requirements. application for sales tax exemption certificate. Office of state tax commissioner. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. this is a sales and use tax exemption for purchasing tangible. North Dakota Sales Tax Exemption Verification.

From blog.accountingprose.com

North 2023 Dakota Sales Tax Guide North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. a sales tax exemption certificate can be used by. North Dakota Sales Tax Exemption Verification.

From www.formsbank.com

Form S2 North Dakota Sales And Use Tax Return printable pdf download North Dakota Sales Tax Exemption Verification if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Office of state. North Dakota Sales Tax Exemption Verification.

From webinarcare.com

How to Get North Dakota Sales Tax Permit A Comprehensive Guide North Dakota Sales Tax Exemption Verification Complete this certifi cate and. sales and use tax requirements. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Office of state tax commissioner. General. North Dakota Sales Tax Exemption Verification.

From zamp.com

Ultimate North Dakota Sales Tax Guide Zamp North Dakota Sales Tax Exemption Verification Complete this certifi cate and. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. if. North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form SFN18085 Download Fillable PDF or Fill Online Tribal Claim for Tax North Dakota Sales Tax Exemption Verification sales and use tax requirements. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. application for sales tax exemption certificate. if you are buying products to resell in the state of north dakota, you can qualify for a. North Dakota Sales Tax Exemption Verification.

From www.exemptform.com

North Dakota Sales Tax Exempt Form North Dakota Sales Tax Exemption Verification if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. this is. North Dakota Sales Tax Exemption Verification.

From stepbystepbusiness.com

How to Get a Certificate of Exemption in North Dakota Step By Step North Dakota Sales Tax Exemption Verification if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. Complete this certifi cate and. application for sales tax exemption certificate. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. General. North Dakota Sales Tax Exemption Verification.

From sd-eform-1932.pdffiller.com

20222024 Form SD Streamlined Sales and Use Tax Certificate of North Dakota Sales Tax Exemption Verification General information and special guidelines for certain types of business. Office of state tax commissioner. sales and use tax requirements. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. this is a sales and use tax exemption for purchasing tangible. North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form SFN21919 Download Fillable PDF or Fill Online Application for North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. General information and special guidelines for certain types of business. sales and use tax requirements. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. . North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form RWTEXM (SFN28265) Fill Out, Sign Online and Download Fillable North Dakota Sales Tax Exemption Verification sales and use tax requirements. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. General information and special guidelines for certain types of business. Complete this certifi cate and. a sales tax exemption certificate can be used by businesses. North Dakota Sales Tax Exemption Verification.

From www.exemptform.com

North Dakota Sales Tax Exempt Form North Dakota Sales Tax Exemption Verification application for sales tax exemption certificate. sales and use tax requirements. Office of state tax commissioner. General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. this is a sales and use tax exemption for purchasing tangible. North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form SFN51717 (E) Fill Out, Sign Online and Download Fillable PDF North Dakota Sales Tax Exemption Verification General information and special guidelines for certain types of business. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Complete this certifi cate and. application for sales tax exemption certificate. if you are buying products to resell in the state of north dakota, you can qualify for. North Dakota Sales Tax Exemption Verification.

From fagor-cool.blogspot.com

north dakota sales tax registration Phat Diary Slideshow North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting. General information and special guidelines for certain types of business.. North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form SFN62298 Fill Out, Sign Online and Download Fillable PDF, North North Dakota Sales Tax Exemption Verification Office of state tax commissioner. General information and special guidelines for certain types of business. application for sales tax exemption certificate. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. sales and use tax requirements. Complete this certifi cate and. a sales tax. North Dakota Sales Tax Exemption Verification.

From www.templateroller.com

Form SFN21999 Fill Out, Sign Online and Download Fillable PDF, North North Dakota Sales Tax Exemption Verification General information and special guidelines for certain types of business. Complete this certifi cate and. a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of. North Dakota Sales Tax Exemption Verification.

From www.exemptform.com

North Dakota Sales Tax Exempt Form North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. Office of state tax commissioner. Complete this certifi cate and. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax exemption on that purchase by presenting.. North Dakota Sales Tax Exemption Verification.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank North Dakota Sales Tax Exemption Verification this is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a facility in north. sales and use tax requirements. General information and special guidelines for certain types of business. if you are buying products to resell in the state of north dakota, you can qualify for a sales tax. North Dakota Sales Tax Exemption Verification.